Blog

Harnessing the benefits of cloud-based finance software for scalability and flexibility

By NETSOL Technologies , on July 12, 2023

Harnessing the benefits of cloud-based finance software provides organizations with the scalability and flexibility which is essential today to thrive in evolving business environments.

By adopting cloud-based financial software solutions, businesses can enhance their operations in today's dynamic environment. Financial software solutions provide advanced financial management capabilities and enable organizations to thrive by leveraging the power of cloud technology and reaping the imminent benefits of the cloud. samar

The shift to financial software on the cloud offers numerous benefits, empowering businesses to streamline their financial operations, adapt to changing market conditions and unlock new growth opportunities.

Financial institutions have rapidly transitioned towards online financial management software on the cloud that not only enables them to conduct their operations with optimum efficiency, but also enables them to substantially reduce their costs, and subsequently, increase their profitability. In the process, cloud-based online financial software offers scalability and flexibility.

The power of the cloud

According to a report published by Gartner, 85% of organizations will be cloud-first by 2025, and without the incorporation of cloud-native architectures and technologies, companies will face limitations in effectively implementing their digital strategies. The report also stated that cloud revenue will surpass non-cloud revenue over the next few years for relevant enterprise IT markets.

85%of organizations will be cloud-first by 2025, according to a report published by Gartner.

Gartner estimated that over 95% of new workloads will be deployed on cloud-native platforms by the year 2025, having grown from 30% in 2021. The adoption of a cloud-first approach enables organizations to manage workloads efficiently. Milind Govekar, Chief of Research, Strategic Portfolio Management at Gartner, stated: "There is no business strategy without a cloud strategy. Adopting cloud-native platforms means that digital or product teams will use architectural principles and capabilities to take advantage of the inherent capabilities within the cloud environment. New workloads deployed in a cloud-native environment will be pervasive, not just popular and anything non-cloud will be considered legacy."

As per a report published by O-Reilley, nearly 90% of organizations use the cloud. According to Fortinet 2021, cloud-based workloads account for 75% of workloads in 1 out of 5 organizations. These figures demonstrate how organizations are now moving towards the adoption of a cloud-first approach to run their operations.

88%of organizations or more use cloud computing, according to results from an O'Reilly survey.

There is no business strategy without a cloud strategy. New workloads deployed in a cloud-native environment will be pervasive, not just popular and anything non-cloud will be considered legacy. - Milind Govekar, Chief of Research, Strategic Portfolio Management at Gartner

The essence of scalability

Today, scalability is crucial for cloud-based financial software in order to meet the evolving needs of modern businesses. With the dynamic nature of financial operations and increasing volumes of data, it has now become essential for software solutions to provide their users with the core features to scale their business seamlessly. Finance software on the cloud leverages the elasticity of cloud infrastructure to effortlessly accommodate growing workloads and adapt to fluctuating demands. Scalability within cloud-based business management software ensures that financial processes are executed efficiently without compromising on performance and the user-experience.

As businesses expand and encounter higher transaction volumes, the software's ability to scale up resources on-demand allows for enhanced processing power, improved data storage capacity and the capability to handle concurrent users. With scalable cloud financial software, organizations can achieve agility, cost-effectiveness and uninterrupted access to critical financial tools and data, enabling them to drive growth, optimize resources and stay competitive in the ever-evolving financial landscape.

Cloud-based financial software offers flexibility that cannot be rivalled by traditional on-premise solutions providing customers and businesses with complete ease to adapt and scale businesses with ease.

Cloud financial software offers flexibility that cannot be rivalled by traditional on-premise solutions providing customers and businesses with complete ease to adapt and scale businesses with ease. With real-time access to data, users can perform their tasks seamlessly. It enables businesses to manage budgets, track expenses and analyze financial trends. The ability to customize workflows and integrate with other business systems enables seamless collaboration and enhances productivity. No matter how often trends change in the dynamic marketplace, cloud-based finance software and technology enables flexibility and scalability for optimal financial management.

Embracing agility and adaptability for ever-evolving business needs

One of the key advantages of cloud calculations is its ability to scale effortlessly. Traditional on-premise systems often struggle to accommodate growing business needs, requiring costly hardware upgrades and infrastructure investments. In contrast, as mentioned, cloud-based solutions allow businesses to scale their financial operations up or down seamlessly, depending on their requirements. Whether a company is expanding its operations or experiencing a temporary downturn, financial management software on the cloud offers the flexibility to adapt quickly without incurring significant costs.

It has now become important for businesses to swiftly respond to changing trends and navigate through them. By enhancing agility and adaptability, companies can proactively address shifting business needs, seize emerging opportunities and effectively mitigate potential risks. This involves fostering a culture of flexibility, continuous learning and innovation within the organization, empowering employees to quickly adapt their skills and expertise to new challenges and opportunities. As a result, improved agility and adaptability enable financial institutions and businesses to maintain a competitive edge and drive sustainable growth.

Reduced IT infrastructure requirements and subsequent cost-effectiveness

According to research, cloud computing boosts gross margins and profitability. This shows why organizations in today's evolving landscape are moving towards the adoption of a cloud-first approach. A cloud-first approach empowers businesses to save IT infrastructure costs by shifting their operations to the cloud.

Finance software on the cloud eliminates the need for substantial upfront investments in hardware, servers and software license fees. Instead, businesses pay for the services they use via flexible, subscription-based pricing, with the option to scale the service up or down as needed. This pay-as-you-go model reduces capital expenditure, making it particularly attractive for small and medium-sized enterprises (SMEs) with limited financial resources.

Finance software on the cloud eliminates the need for substantial upfront investments in hardware, servers and software license fees. Instead, businesses pay for the services they use via flexible, subscription-based pricing.

Additionally, the cloud-based approach shifts the responsibility for infrastructure maintenance and upgrades to the software provider, reducing the burden on the company's IT department. Further, reduced IT infrastructure leads to reduced energy consumption contributing to environmental sustainability while freeing up resources for other strategic initiatives.

Empowering remote teams through enhanced collaboration and accessibility

Financial software solutions on the cloud provide real-time accessibility to financial data from anywhere, at any time. This level of accessibility is especially valuable in today's increasingly remote and globalized business environment, with many team members working from home/the office/a hybrid and from different geographical locations across the world. This results in real-time collaboration, efficient workflow management and seamless data sharing among team members.

Team members can collaborate on financial tasks, regardless of their physical location, facilitating efficient communication and decision-making. Moreover, cloud-based platforms enable stakeholders to access the most up-to-date financial information, ensuring transparency and accuracy across the organization.

Integration capabilities and seamless data sharing

Managing data dispersed across various sources presents a difficulty when it comes to extracting crucial insights for business purposes. The process of integration aids in centralizing, refining and purging this data, allowing users to gain a comprehensive understanding of all significant enterprise interactions. By consolidating financial data from various sources, this consolidated information can then be leveraged to extract valuable insights and facilitate informed decision-making for improved business outcomes.

Integration eliminates manual data entry and enables automated processes, reducing the risk of errors and increasing operational efficiency.

Cloud-based financial software solutions offer businesses with seamless integration capabilities such as with customer relationship management (CRM) and enterprise resource planning (ERP) platforms. Integration eliminates manual data entry and enables automated processes, reducing the risk of errors and increasing operational efficiency.

Other benefits

By leveraging the cloud's computing power, businesses are empowered with powerful analytics and reporting capabilities via generating real-time financial insights and visualizing data through intuitive dashboards and customizable reports. These tools enable informed decision-making, identify trends and patterns and provide a holistic view of the company's financial health. Access to timely and accurate financial information is critical for strategic planning, budgeting and forecasting, allowing businesses to adapt swiftly to market changes and make data-driven decisions.

Cloud financial software also has in place stringent security mechanisms to protect sensitive financial data. Reputable cloud providers invest heavily in advanced security protocols, encryption and regular backups, ensuring data integrity and mitigating the risk of any data breaches. Additionally, cloud-based solutions often adhere to strict compliance regulations.

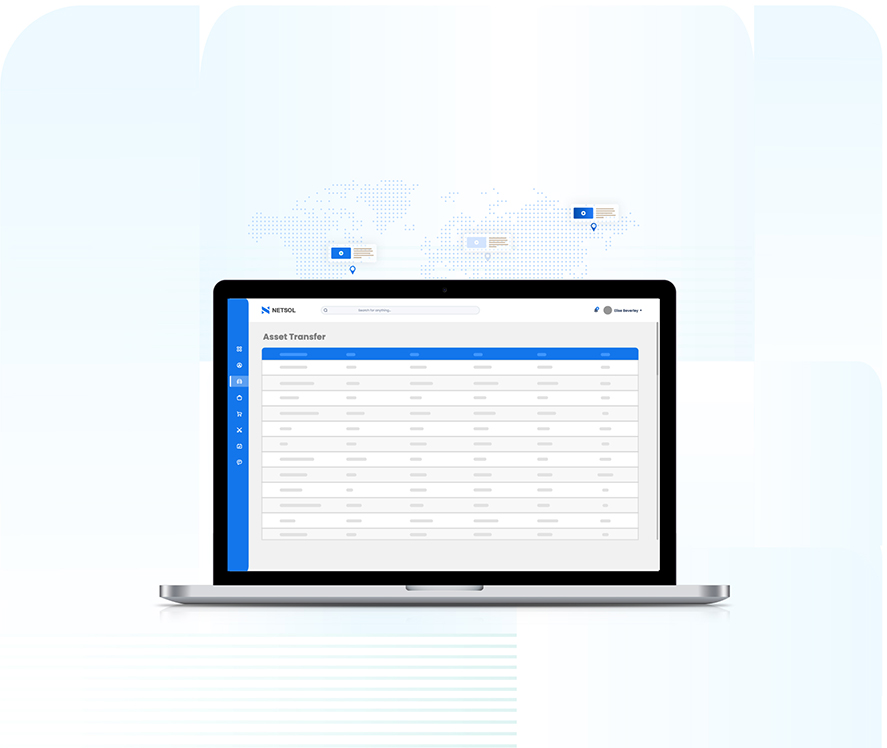

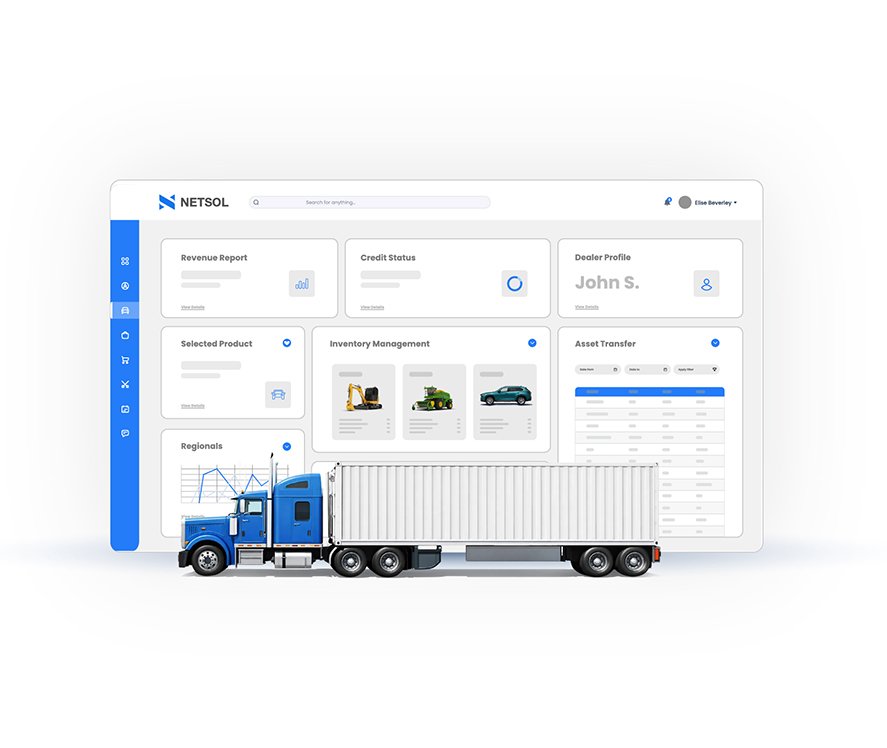

NETSOL's premier, unrivalled platform Ascent is available on the cloud

NETSOL's premier product NFS Ascent is a highly adaptive modern technology platform for the global asset finance and leasing industry. Used by world leading captives, automotive and equipment finance and leasing companies alongside banks to futureproof their operations worldwide, Ascent is an unrivalled solution. It is also offered on the cloud, enabling smaller financial institutions to attain immediate access to the same premier product used by bluechip and Fortune 500 companies across the globe, without having to pay any upfront license fees!

NETSOL's premier platform Ascent (on the Cloud) enables smaller financial institutions to attain immediate access to the same premier product used by bluechip and Fortune 500 companies without having to pay any upfront license fees!

Ascent on the Cloud is available via flexible, subscription-based pricing, a rapid deployment process and the ability to scale on demand!

NETSOL is a select-tier partner of Amazon Web Services (AWS)

NETSOL is also a select-tier partner with Amazon Web Services (AWS). Since AWS is the most comprehensive and highly adopted cloud offering, NETSOL has been leveraging its power to ensure lower costs, an exceedingly agile and secure environment and innovative solutions across all domains.

From cloud storage to cloud backup, NETSOL delivers intelligent cloud enterprise platform, meeting the challenging demands of an evolving future and creating a difference. Our trusted process is utilizing the power of analytics and data lakes, serverless computing, artificial intelligence and machine learning, blockchain, IoT and other technology solutions to create a seamless path of cloud solutions and services.

Conclusion

Harnessing the benefits of cloud-based finance software provides organizations with the scalability and flexibility which is essential today to thrive in evolving business environments. When assessing the best finance management software, the adoption of a cloud-first approach enables businesses to optimize workflows, enhance financial management capabilities and drive growth while keeping costs at a minimum. The scalability of cloud financial software allows for seamless adaptation to changing demands, ensuring seamless operations as transaction volumes increase.

The cloud can revolutionize financial management for businesses of all sizes. Harnessing the benefits of cloud-based finance software offers organizations the opportunity to achieve scalability and flexibility in their financial operations. With improved agility, cost-effectiveness, enhanced collaboration and seamless integration capabilities, finance software on the cloud is a powerful and essential tool for organizations to achieve optimal financial management and maintain a competitive edge.

Related blogs

Blog

Navigating change management in long-term projects - Lessons from the field

Blog

The digital imperative for brokers: Why automation will define the next era of asset finance

Blog