Equipment finance

AI-powered equipment finance software

We provide equipment finance solutions to companies with ever-growing business requirements worldwide.

Equipment finance

Harness the power of unmatched equipment finance technology

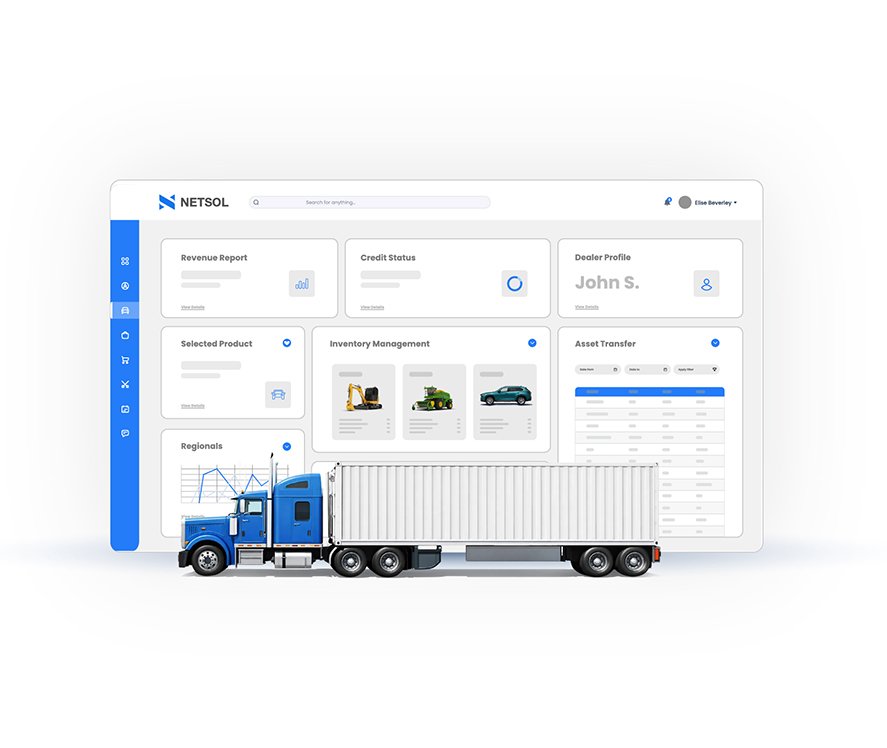

While you enable organizations to procure the equipment necessary to meet the growing demands of their business, we provide you with the technology that covers the end-to-end equipment finance cycle effortlessly. Whether it's heavy machinery, agricultural, industrial or any form of equipment you finance, we streamline processes and drive growth.

Proven technology

With a proven track record, NETSOL's lease management software for OEMs and the equipment finance sector supports highly complex business environments.

End-to-end solutions

For OEMs and equipment finance and leasing businesses, NETSOL has solutions for originations, servicing, wholesale, as well as digital retail and more.

Customer-centricity

With an experienced global team delivering superior solutions, NETSOL follows a customer-centric product development approach for the industry.

Full compliance

To ensure compliance with various international quality standards, we meticulously adhere to all regulatory and legal requirements worldwide.

0

Assets managed globally

0

Successful implementations

0

Customers worldwide

0

Countries served

-699ec45abc1c6.png)