Blog

Guardian of the digital realm: The power of AI in cybersecurity

By Asif Zafar Head of Cybersecurity at NETSOL Technologies, on February 27, 2024

Dive into the transformative world of AI in cybersecurity. Delve into insights on threat detection and fraud prevention in securing the digital realm.

The evolving cyber threat landscape

To set the stage for our exploration of AI in cybersecurity, let's first examine the evolving cyber threat landscape that financial institutions face. According to Forrester, cyberattacks on financial services firms have surged by 238% in recent years, with an average cost of $5.1 million per breach. These statistics underscore the pressing need for advanced cybersecurity solutions.

Gartner reports that traditional cybersecurity methods are no longer sufficient, as cybercriminals employ increasingly sophisticated tactics. Ransomware attacks, phishing scams and insider threats have become more pervasive, necessitating innovative approaches to defense. VMware in its Modern Bank Heists report showed that attacks on financial institutions increased 17% from 2022.

The rise of AI in cybersecurity

As financial institutions grapple with the mounting cyber threats, AI has emerged as a game-changer. AI's ability to analyze vast amounts of data in real-time, identify anomalies and adapt to new attack vectors positions it as a formidable ally in the battle against cybercrime.

Gartner predicts that by 2025, 80% of financial firms will adopt AI for cybersecurity. Deloitte notes that AI enhances the accuracy and speed of threat detection by 20-30%, minimizing response times and reducing the risk of financial loss.

1. AI-powered threat detection

AI plays a crucial role in enhancing cybersecurity, particularly in the realm of threat detection. AI algorithms are adept at scrutinizing network traffic, user behavior and system logs to identify irregularities that may signify a cyberattack.

In the domain of cybersecurity, there are various approaches to leverage AI and it is imperative to determine the most suitable one for an organization. Some software applications focus on scrutinizing raw network data to pinpoint anomalies, while others concentrate on analyzing user, asset or entity behavior to detect patterns that deviate from the norm. The methods of collecting and processing data streams differ among these approaches, as does the level of effort required by analysts. Cybersecurity solutions that harness AI and machine learning (ML) can significantly reduce the time required for threat detection and incident response. They often have the capability to alert cybersecurity staff in real-time when they detect anomalous behavior. Furthermore, these technologies aid in the reduction and prioritization of traditional security alerts, thereby enhancing the effectiveness of existing investments in different tools and technologies.

It's worth noting that attackers are also harnessing AI and ML to gain a better understanding of their targets and launch more sophisticated attacks. While AI enhances organizations' abilities to identify and respond to attacks, it may inadvertently help cybercriminals learn about their target's vulnerabilities. Many cybersecurity product companies have turned to AI and ML to provide insights that would be otherwise unattainable through human efforts alone. These products utilize AI to identify anomalies, expedite detection processes and amplify the efficacy of existing security products.

AI can provide valuable assistance to overwhelmed analysts who are bombarded with security alerts, helping them identify patterns that might indicate threats overlooked by conventional cybersecurity software. Without this assistance, analysts may waste time investigating "false positive" alerts and pursuing dead-end leads, while genuine malicious activities go unnoticed. A study conducted by a prominent non-profit security organization in the United States revealed that organizations can squander as much as $1.3 million per year responding to "inaccurate and erroneous intelligence" or "chasing erroneous alerts."

The best results are achieved by utilizing ML to analyze extensive sets of human-labeled data, enabling the identification of patterns within the noise. Historically, the training of AI/ML models has been a time-consuming and arduous aspect of AI/ML implementation. However, several AI solutions have emerged that enable the software to autonomously train itself to some extent. With proper training, AI threat analysis can emulate human intuition when assessing every interaction on the network, effectively singling out unusual packets from millions of others for human review.

Cutting-edge AI products even enable companies to correlate attacks or events across time and geographical locations, providing a more comprehensive understanding of network activities. When vigilantly monitored, solutions that employ ML for threat detection can significantly reduce the time elapsed between a breach and its discovery. This reduction in the time to discovery is of paramount importance in cybersecurity, as the average breach still takes over 260 days to be identified and addressed.

Precision in detection

AI algorithms can detect subtle indicators of cyber threats that human analysts might overlook. KPMG's research shows that AI-enhanced detection boasts an accuracy rate of up to 90%, significantly reducing false positives. This precision is paramount in preventing unnecessary disruptions and ensuring that legitimate transactions proceed without delay.

Adaptation and learning

Cybercriminals constantly refine their tactics, creating the need for organizations to enhance their defenses. AI systems excel in this aspect, continuously learning from new threats and adapting their detection mechanisms. As a result, financial institutions can stay ahead of zero-day attacks and emerging vulnerabilities.

Real-time response

In the digital age, every millisecond counts. AI enables financial organizations to respond swiftly to potential threats. KPMG's analysis shows that AI-driven incident response can reduce response times by up to 60%, allowing organizations to contain and mitigate cyberattacks more effectively.

Proactive defense

Beyond just identifying existing threats, AI can anticipate potential vulnerabilities. By analyzing historical data and identifying patterns, AI can proactively enhance cybersecurity measures, making it an invaluable tool in the ongoing battle against cybercrime.

Moreover, AI's ability to recognize previously unseen threats is a game-changer. Forrester data shows that 68% of financial institutions believe AI helps them identify zero-day attacks and previously unknown vulnerabilities, enhancing their proactive cybersecurity posture.

AI's impact on insider threat detection

Insider threats pose a significant risk to financial institutions, as employees with malicious intent or inadvertent negligence can compromise security. KPMG's analysis indicates that AI has improved the identification of insider threats by 45%, helping organizations preemptively address these risks.

AI's ability to monitor user behavior and identify deviations from normal patterns is invaluable in detecting insider threats. Deloitte reports that AI can identify insider threats 85% faster than traditional methods, reducing the potential for data breaches.

2. AI in fraud prevention

The escalating battle against financial fraud

Financial fraud remains a significant concern for the financial services industry. According to recent data from the Federal Trade Commission (FTC), consumer losses due to scams amounted to nearly $8.8 billion in 2022, an increase of more than 30% over the previous year. This number underscores the urgent need for robust fraud prevention measures.

AI's critical role in fraud detection

Real-time detection and prevention

AI-powered fraud prevention systems have the ability to analyze vast streams of transactional data in real-time, a capability unmatched by traditional methods. This allows financial institutions to detect and prevent fraudulent activities as they occur. A report by McKinsey states that AI can reduce false positives by up to 80%, saving both time and resources.

Advanced behavioral analyticsAI excels at behavioral analytics, enabling it to identify patterns and anomalies in user activity. It can detect deviations from a customer's typical behavior and raise red flags accordingly. As of 2023, financial institutions that use AI for behavioral analytics have reported a 90% improvement in fraud detection rates, according to Accenture.

Predictive modelingOne of AI's most potent capabilities is predictive modeling. By analyzing historical data and market trends, AI can forecast potential fraud risks. This proactive approach is particularly effective in identifying emerging fraud patterns. Deloitte's research indicates that AI-driven predictive models have reduced fraud-related losses by up to 50%.

Reducing false positivesFalse positives, where legitimate transactions are mistakenly flagged as fraudulent, can be a significant inconvenience for customers. AI, through continuous learning, fine-tunes its algorithms, resulting in fewer false alarms. This leads to a smoother customer experience.

AI enhancing efficiency

The integration of AI into fraud prevention systems has ushered in a new era of efficiency for financial institutions.

Speed and scalabilityAI can process vast amounts of data at an unprecedented speed. It's estimated that AI can analyze over 1 million transactions per second. This level of scalability ensures comprehensive fraud detection coverage, even as transaction volumes continue to rise.

Reducing investigative workloadFinancial crime investigators often find themselves drowning in data. AI-driven tools, such as natural language processing (NLP) and ML, assist analysts by automating the analysis of unstructured data sources, including emails and chat logs.

AI as a double-edged sword

While AI has proven to be a formidable ally in the fight against fraud, it's essential to recognize that cybercriminals are also harnessing AI and ML to refine their tactics. These malicious actors leverage AI to analyze data, identify vulnerabilities and launch more sophisticated cyber-attacks.

To counter this, financial institutions must continuously invest in AI research and development to stay ahead of evolving threats. Additionally, AI can be used to bolster it information security services by detecting unauthorized access and unusual system behavior, helping to thwart potential breaches.

According to Gartner, the main benefits of using AI in cybersecurity are to increase detection speed, utilize predictive capabilities and reduce errors. In 2023, AI's role in fraud prevention within the financial services industry has reached new heights. Its ability to provide real-time detection, advanced behavioral analytics, predictive modeling and reduced false positives is transforming the way financial institutions combat fraud. With relevant statistics demonstrating substantial improvements in fraud detection rates and operational efficiency, it's clear that AI is not just a valuable tool, but a necessity in the ongoing battle against cybercrime and financial fraud.

However, financial institutions must remain vigilant and adaptive in the face of evolving threats, as cybercriminals are also harnessing AI for their nefarious purposes. By staying at the forefront of AI-powered fraud prevention, the financial services industry can safeguard both its assets and the trust of its customers in this ever-changing threat landscape.

As financial professionals across the globe navigate the dynamic landscape of finance and leasing, they must recognize that AI is the vanguard of their digital future. It is the guardian of finance, tirelessly defending against cyber adversaries and securing the foundation upon which the industry's success depends.

Related blogs

Blog

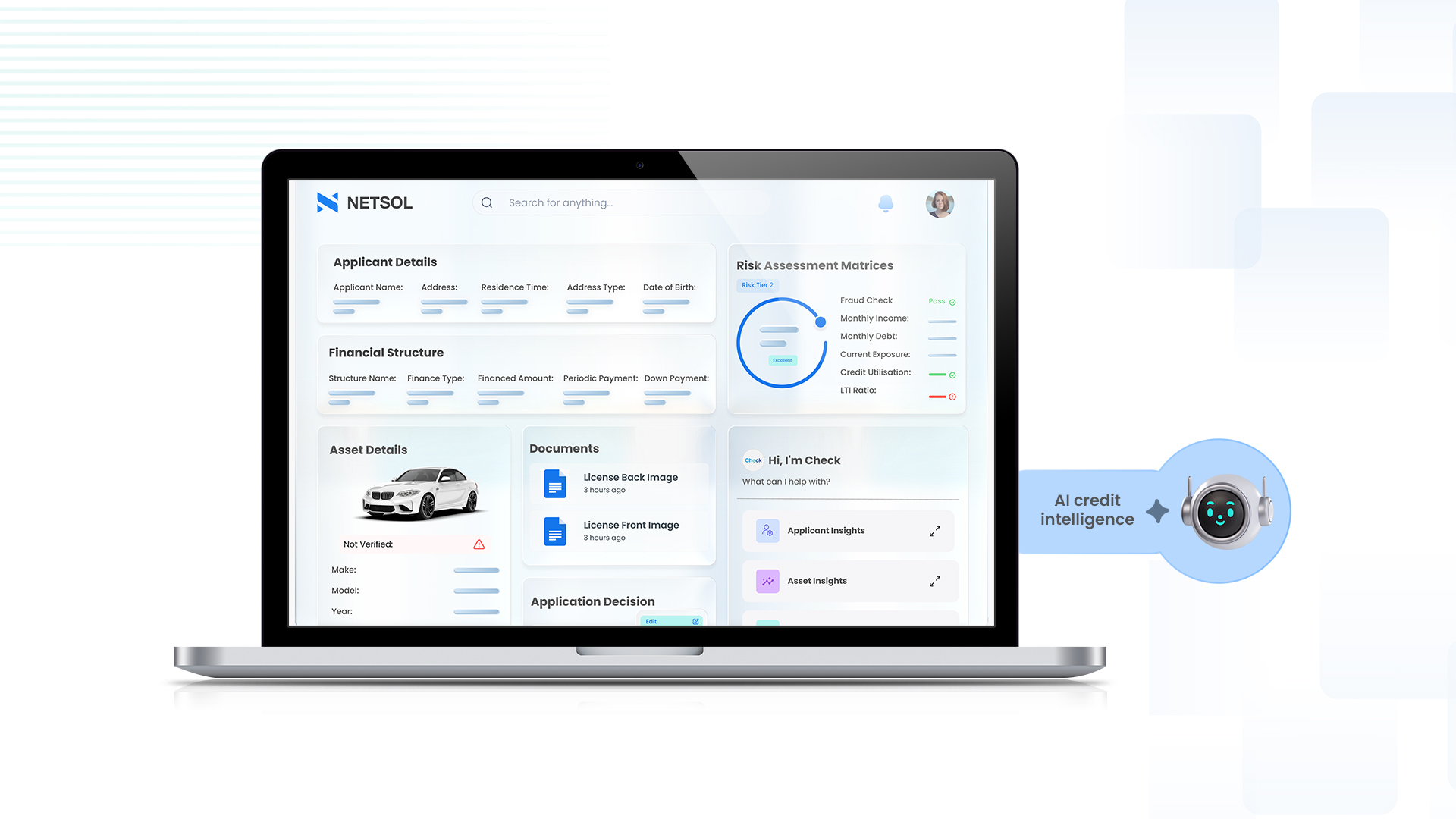

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog