Blog

The Transformative role of digitization in the car buying journey

By Sehar Azhar Marketing Manager North America at NETSOL Technologies Inc., on July 26, 2023

Explore how digitization in the car buying journey enhances convenience, revolutionizes dealership strategies, and drives growth with cutting-edge technologies.

In the modern era, the automotive industry is undergoing a profound transformation, driven by the rapid advancement of digital technologies. As consumers increasingly turn to digital platforms for various aspects of their lives, the car buying journey is no exception. Digitization has revolutionized the way potential buyers research, evaluate and ultimately purchase vehicles.

Digitization has profoundly transformed the purchasing journey, benefiting consumers, digital solutions for retail and the automotive industry as a whole.

The digital transformation of the automotive industry is gradually reducing the need for over-the-top showrooms. In-person negotiations have also shifted, leading lenders to focus on strengthening their online presence. This change has been primarily influenced by the widespread adoption of online shopping experiences that consumers heavily rely on. Today's technology-driven consumers prefer online sources of information as their primary decision-making tool.

Driving revenue surge: Unlocking growth potential

Digitization capabilities are important for increasing revenue. It comes with competitive advantages and the implementation of strong e-commerce helps with revenue growth due to the increase in demand for a better user experience leading to increased conversions. More customers are seeking and using digital alternatives. Most particularly, recent research shows that the ability to search for nearby vehicles and check their availability plays a significant role in driving sales on auto dealerships websites. This, in turn, directly impacts sales.

Lenders adopting digital processes are outperforming those relying on manual methods. The accelerated digitization, driven by the pandemic, has facilitated contactless interactions, faster loan origination and reduced costs. With valuable lessons learned during the economic slowdown, lenders are actively integrating automated technology to optimize their capabilities and stay abreast of evolving trends in auto ownership. Thanks to cutting-edge auto finance software solutions, consumers can enjoy a seamless purchasing experience and avoid any unnecessary delays.

75%of car buyers preferred a combination of online and in-person elements in their vehicle purchase process (Research by Capital One).

Research by Capital One, an American bank holding company specializing in auto loans and banking, indicates that the majority of car buyers, approximately 75%, express a preference for a vehicle purchase process that incorporates a combination of online and in-person elements. In 2021, the global online car buying market generated an impressive revenue of USD 256 billion and is expected to soar to USD 722 billion by 2030, growing (CAGR) at 12.21% during the forecasted period of 2022 to 2030. North America is poised to lead the market, with a projected CAGR of 10.51% during the same period.

Lenders adopting digital processes are outperforming those relying on manual methods. The accelerated digitization, driven by the pandemic, has facilitated contactless interactions, faster loan origination and reduced costs.

In the past year, a number of car buyers have experienced different perceptions of the car buying process based on their use of digital tools for financing. Around 45% of buyers who utilize digital tools have found the experience to be increasingly easier, while approximately 50% of those who do not use such tools have encountered greater difficulties. Before heading to the dealership, a majority of car buyers, about 59%, prefer to conduct online research to gather information about vehicles. Additionally, slightly over one-third, around 34% of buyers, prioritize understanding their financing options. Notably, 28% of dealers expect car buyers to engage in car research before visiting their dealerships.

59%of car buyers preferred to conduct online research to gather information about vehicles before heading to the dealership (Research by Capital One).

Achieving a new standard for the buyer experience

A thriving online marketplace can greatly improve the car buying experience for customers, offering them more personalized and hassle-free options. With advanced features like real-time inventory updates, self-service tools, virtual reality customization and simplified interactions with dealerships, buyers can take charge of the process and enjoy a smoother journey. By providing up-to-date information on available vehicles, the online offering enables customers to explore their options whenever they want. They can research, compare and configure cars from the comfort of their homes, customizing features through VR technology.

Online platforms also simplify interactions with dealerships, allowing customers to schedule test drives, negotiate prices and handle paperwork digitally. An auto loan calculator adds in the vital steps of making the journey a lot easier. It helps with providing the best information on financing your car, finding the right down payment, monthly installments and so on. This transparency allows buyers to make informed decisions regarding their financial commitments and ensures a more straightforward and efficient purchasing process.

Embracing the benefits of digitization, the market puts buyers in control, empowering them with information and tools to make informed decisions.

This convenience not only saves time and effort at the physical dealership but also allows them to proceed with their journey online. Embracing the benefits of digitization, the market puts buyers in control, empowering them with information and tools to make informed decisions. It transforms the car buying experience by offering greater convenience, customization, and subsequently, satisfaction.

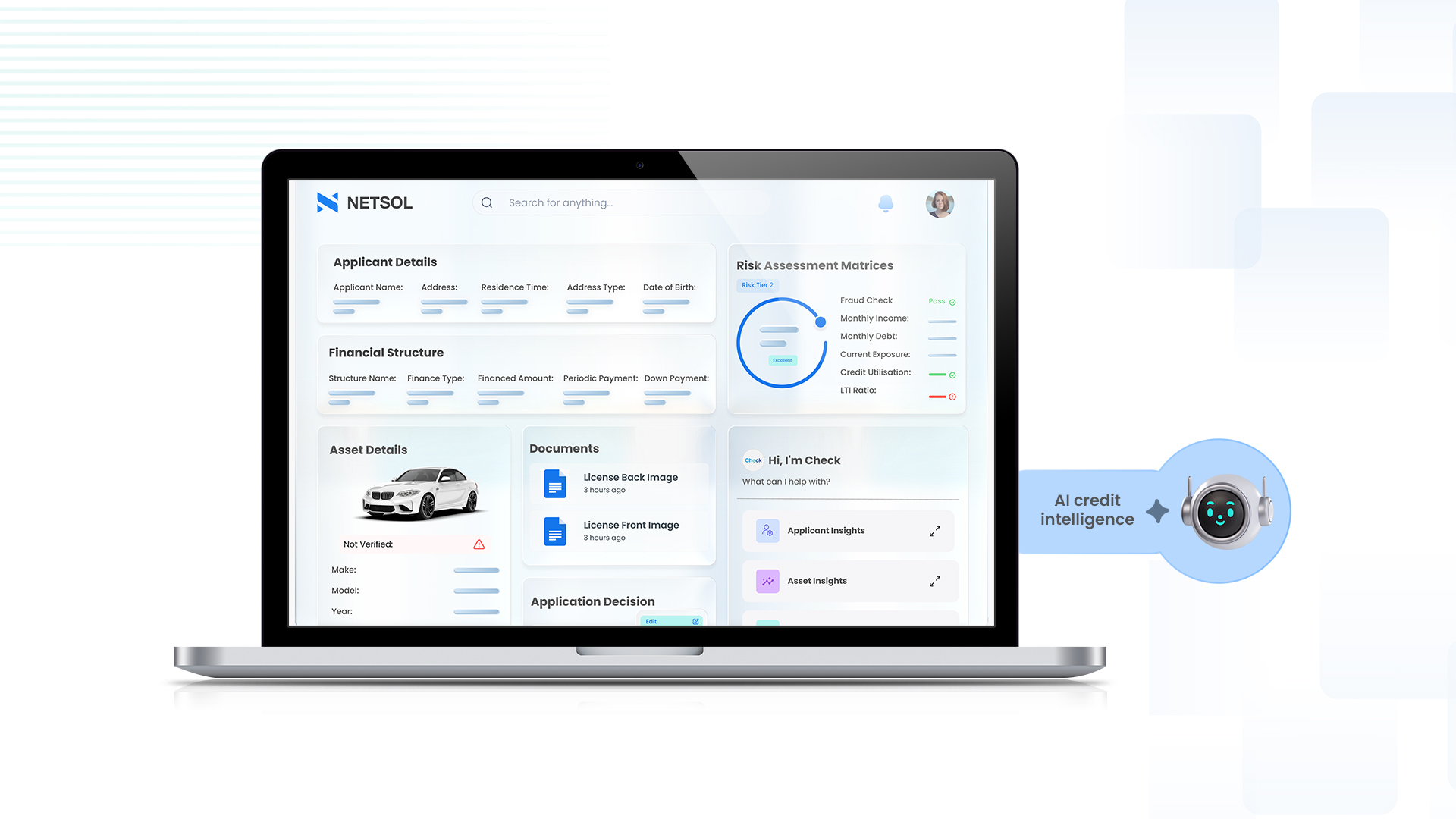

In addition to this, an integrated credit approval module further enhances the customer experience in the online marketplace. By seamlessly integrating their credit application and approval process into the digital platform, customers are able to share their financial information with the lender directly. This again increases the customer-centricity of the experience by further streamlining the journey.

OEMs drive the global online car buying market

With digitization taking over the world like a storm and everyone adapting to the change, OEMs are not behind. They have been exploring online sales to enhance their customers' digital experience, offering features like increased price transparency, convenient home purchasing and digital payment options.

For the purpose of boosting online sales, Volkswagen is introducing a new range of electric vehicles alongside an advanced IT infrastructure that is expected to increase the demand for online sales exponentially. European automakers like Volvo, Hyundai, JLR, BMW and MINI focus their online sales strategies on specific markets and some of these OEMs are putting efforts into making online-only sales models.

Expanding the customer footprint

Dealers can expand their customer footprint through digitization by implementing various strategies and leveraging the power of digital technologies. Here are some key approaches:

- Online Presence: Establishing a strong online presence is crucial in reaching a wider customer base. Dealers can create user-friendly websites, optimize them for search engines and actively engage on social media platforms to attract and connect with potential customers.

-

E-commerce/Digital Retailing Platforms: Adopting e-commerce platforms allows dealers to showcase their inventory, provide detailed product information and offer online purchasing options that ultimately allow for an end-to-end experience. This enables customers to explore and buy vehicles from anywhere, expanding the dealer's reach beyond physical boundaries.

Highly advanced platforms even integrate AI/ML technologies that help in offering personalized recommendations for cetrain vehicles, automotive financing, F&L options and more, based on previous searches or purchasing history.

By way of integrating with fraud and KYC modules, the online buying journey becomes an even safer environment for dealers who are increasingly experiencing fraudulent transactions all around.

Additional features such as the integration of insurance options for collision and liability as well as offering a payment module and a scheduler completes all of the necessary steps along any sophisticated vehicle buying journey.

-

Online Vehicle Research Tools and Vehicle Leasing Software/Auto Finance Software: Offering comprehensive online vehicle research tools, including detailed vehicle descriptions, high-quality images/videos and virtual tours, along with integrated vehicle leasing software or auto finance software enables customers to explore leasing and financing options alongside traditional purchasing. This provides customers with greater flexibility and expands the dealer's potential customer base by catering to individuals who prefer leasing or financing over buying.

By providing transparent leasing and/or financing information, calculating lease payments and facilitating the application process online, dealers can attract and engage customers who are interested in leasing or financing as a viable option. The integration of vehicle leasing software or auto finance software within the digital platform streamlines the leasing or financing process, making it more convenient and accessible for customers, thus expanding the dealer's customer footprint in the market.

- Digital Marketing: Implementing targeted digital marketing campaigns, such as search engine marketing (SEM), search engine optimization (SEO) and social media advertising helps dealers promote their brand, inventory and special offers to a larger audience.

- Customer Relationship Management (CRM) Systems: Utilizing CRM systems allows dealers to manage customer data effectively. By leveraging customer insights and preferences, dealers can personalize marketing efforts, provide tailored recommendations and nurture long-term relationships with customers.

- Virtual Showrooms and Test Drives: Embracing virtual showrooms and virtual test drive experiences allows dealers to reach customers who may be located far away or prefer a remote buying experience. These virtual interactions provide an immersive and interactive way to showcase vehicles and build customer confidence.

By implementing these digital strategies, dealers can expand their customer footprint, reach new markets and tap into a broader audience, ultimately driving growth, increasing sales and enhancing their overall market presence.

Conclusion

In conclusion, digitization has played a vital role in transforming the car buying experience, offering consumers a range of benefits and revolutionizing the automotive industry. As the automotive industry continues to evolve, the role of digitization will only become more significant. Dealerships must adapt to the changing landscape and invest in innovative digital solutions to stay competitive. By leveraging the power of digitization, the car buying experience will continue to evolve, providing customers with greater convenience, customization and confidence in their purchasing decisions.

Dealerships must adapt to the changing landscape and invest in innovative digital solutions to stay competitive.

In summary, digitization has been a driving force in transforming the car buying experience, enabling customers to enjoy a more personalized, efficient and empowering journey. The future holds even more exciting possibilities as technology continues to advance, promising an automotive landscape that is customer-centric, digitally integrated and constantly evolving to meet the developing needs and preferences of car buyers.

NETSOL's premier solutions for the global automotive finance and leasing industry and for digital auto retail

NETSOL has been proudly serving world renowned auto captives and automotive finance and leasing companies with smart software technology for over four decades. Explore our modern technology solutions for the evolving global automotive finance and leasing industry.

NETSOL's premier, unrivalled platform for the global asset finance and leasing industry NFS Ascent enables automotive and equipment finance and leasing companies, alongside banks, worldwide, to manage their retail and wholesale finance business seamlessly. It is designed to empower finance and leasing companies with a platform that supports their growth in terms of business volume and transactions.

NETSOL's premier, unrivalled platform NFS Ascent enables automotive and equipment finance and leasing companies, alongside banks, worldwide, to manage their retail and wholesale finance business seamlessly.

To learn more about Ascent (Also available on the Cloud via flexible, subscription-based pricing options, a rapid deployment process and the ability to scale on demand).

NETSOL's wholly-owned subsidiary Otoz provides an automotive retail platform, enabling customers with an end-to-end fully digital car buying and mobility journey. It empowers the OEM's and large dealer groups' marketing strategies to create a true Omni-channel experience.

To further facilitate seamless customer and dealer engagement, Otoz integrates with a host of complementary partners, including but not limited to, inventory management systems, trade-in valuation companies, CRM systems, insurance marketplaces, F&L providers and finance companies.

Related blogs

Blog

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog