Blog

Simplifying contract management: The essential role of finance and leasing technology

By NETSOL Technologies , on August 13, 2024

Discover how finance and leasing technology is simplifying contract management, enhancing accuracy in your business operations and driving better financial outcomes.

Finance and leasing businesses handle a complex array of contracts, payment schedules, compliance requirements, renewal terms and much more. Traditionally, this process was manual and prone to errors, leading to inefficiencies and increased administrative overheads. Leveraging advanced finance and leasing technology is key to simplifying these processes, reducing administrative burdens and enhancing accuracy. By integrating sophisticated contract lifecycle management software solutions, companies can transform how they manage contracts, ensuring better compliance, improved operational efficiency and a more seamless experience for all stakeholders involved.

The challenges of traditional contract management

Before the advent of advanced contract management software, the global finance and leasing industry faced a number of setbacks, including, but not limited to:

Manual processes

Contract management was often handled through paper-based processes, with files stored in physical cabinets. This approach was time-consuming and made tracking amendments, renewals and compliance difficult.

Risk of errors

Manual data entry and document handling increased the risk of errors, such as incorrect payment schedules or missed deadlines. Such mistakes could lead to financial losses or legal complications.

Lack of transparency

Without centralized systems, accessing contract details and status updates was challenging. This lack of visibility could hinder decision-making and lead to delays in resolving issues.

Compliance and regulatory concerns

Ensuring adherence to legal and regulatory requirements was cumbersome. Tracking compliance manually often resulted in oversight and potential legal risks.

How cutting-edge enterprise contract management software solutions address these challenges

According to a previous report by EY, although 70% of organizations have a formal contracting technology strategy, over 90% lack the data and technology necessary to enhance their contracting process. This highlights a substantial gap between strategic planning and effective implementation.

The advent of modern technology-based contract management software has revolutionized the finance and leasing industry worldwide by addressing these challenges and offering numerous benefits for finance and leasing businesses, including banks, automotive and equipment finance and leasing companies and other financial institutions.

Centralized document management

Software solutions provide a centralized repository for all contract-related documents. This digital storage eliminates the need for physical files and makes accessing, reviewing and updating contracts more efficient. Users can quickly locate specific documents, track revisions and ensure that all necessary paperwork is in order.

Automated workflows

Contract management technology automates key processes, such as generating lease agreements, tracking payment schedules and sending renewal reminders. Automation reduces the manual workload, minimizes errors and ensures that critical tasks are completed on time. For example, automated alerts can notify stakeholders of upcoming lease expirations or required maintenance, helping to avoid costly delays or penalties.

Enhanced accuracy and compliance

By integrating with other systems, such as financial and CRM platforms, contract management software ensures data consistency and accuracy. It reduces the risk of errors associated with manual data entry and helps maintain compliance with legal and regulatory requirements. Built-in compliance checks and reporting features allow businesses to monitor adherence to contractual obligations and regulatory standards more effectively.

Real-time tracking and analytics

Modern software solutions offer real-time tracking of contract status, payment schedules and performance metrics. This visibility enables finance and leasing companies to make informed decisions, identify trends and optimize their operations. Advanced analytics can provide insights into asset utilization, financial performance and customer behavior, facilitating strategic planning and operational improvements.

Improved collaboration

Contract management solutions enhance collaboration among stakeholders by providing a shared platform for communication and document sharing. This feature is particularly valuable in equipment leasing, where multiple parties, including lessors, lessees and maintenance providers need to coordinate. Asset finance software solutions enable seamless communication, reduce the risk of misunderstandings and ensure that all parties are aligned with the contract terms.

Enhanced security

Protecting sensitive information is crucial in contract management. Software solutions offer robust security features, such as encryption, access controls and audit trails to safeguard contract data. These measures help prevent unauthorized access, data breaches and loss of critical information, ensuring the integrity and confidentiality of contracts.

The future of contract management for the global finance and leasing industry

Simplifying contract management system is transforming the finance industry by addressing traditional challenges and offering numerous benefits. By centralizing document management, automating workflows, enhancing accuracy and improving collaboration, technology solutions are driving efficiency and profitability in the sector globally.

Forrester speculates that the contract management software market will reach $12 billion by 2025. Additionally, research by World Commerce and Contracting (WCC) revealed that over 80% of those they surveyed intend to adopt contract automation software in the future.

As technology continues to evolve, the future of contract management in the global finance and leasing industry is likely to see even more advancements. Top emerging trends in finance, such as AI, ML and blockchain are poised to further enhance the capabilities of enterprise contract management software.

Genertive AI tools can analyze contract data to predict potential risks, optimize lease terms and automate complex decision-making processes. ML algorithms can continuously improve the accuracy of contract management by learning from historical data and identifying patterns. Further, blockchain technology offers secure and transparent contract management through decentralized ledgers, reducing the risk of fraud and ensuring the authenticity of contract records.

As businesses continue to embrace digital transformation, the role of technology for seamless contract management will become increasingly critical. Leveraging advanced technologies and staying abreast of industry trends will enable finance and leasing companies to stay competitive and thrive in a rapidly evolving market. Ultimately, the integration of sophisticated software solutions will empower businesses to manage their financing and leases more effectively, paving the way for a more streamlined and successful future.

When selecting the best contract management software, it is imperative for financial institutions to opt for a platform which essentially futureproofs their operations. Powerful contract management software features must enable enhanced accuracy and faster processing to advanced risk management and improved compliance. It is essential for banks and finance companies to proceed with a contract management technology solution that will enable them to achieve greater efficiency, reduce costs and make data-driven decisions that drive strategic success.

NETSOL's Contract Management System (CMS): An end-to-end solution for contract management

Part of its end-to-end finance and leasing platform Ascent, NETSOL's Contract Management System (CMS) is a powerful, highly agile and functionally rich application for managing and maintaining detailed credit contracts throughout their lifecycle - from pre-activation and activation through customer management, asset financial management, billing and collections, finance and accounting, restructuring and maturity. Based on flexible service-based architecture, with a powerful business process designer and adhering to a wide range of global standards compliance, NETSOL's Contact Management System (CMS) is a comprehensive end-to-end solution for contract management. With enhanced security and accuracy of portfolios, the proven solution is used by financial institutions worldwide.

Equipped with accounting, tax and other standard regulatory and compliance requirements - spanning a wide-range of global standards - our Contract Management System (CMS) simplifies even the most complex business operations in world markets. Powerful tools maintain the security and accuracy of your lease and loan portfolios while enabling seamless transactions with multiple business partners and virtually unlimited scalability to accommodate business growth.

Automate and seamlessly manage your contract management operations. Configure it directly to map specific business needs and manage critical stages of the contract lifecycle effortlessly. Explore our Transcend Finance platform and simplify your everyday operations!

Related blogs

Blog

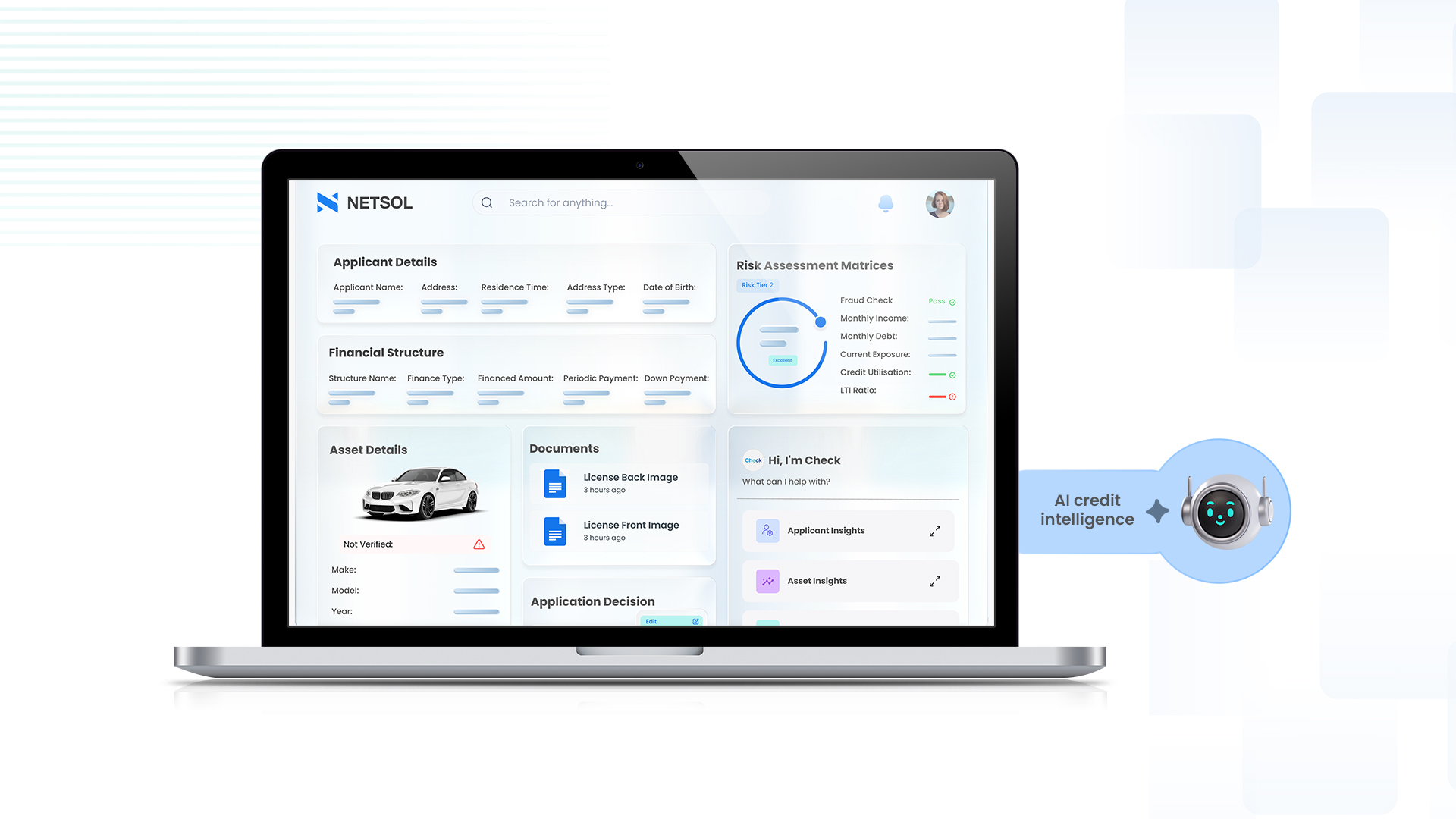

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog