Blog

AI in BFSI: Empowering risk leaders to build scalable and secure solutions

By NETSOL Technologies , on October 20, 2025

AI is transforming BFSI risk management with predictive analytics, AML scoring, automated KYC, and strong governance, driving accuracy, speed, and compliance.

In our first blog, "AI in BFSI: Revolutionizing Risk Management", we explored how AI is reshaping risk management in the banking, financial services, and insurance sectors, driving greater efficiency, accuracy, and security. From predictive analytics to AI-powered fraud detection, we highlighted the profound impact of AI in mitigating risks and improving decision-making.

Part 2 of this series examines how artificial intelligence is driving measurable impact across BFSI risk management. Building on the strategic context set out earlier, this instalment highlights real-world AI use cases, the core capabilities risk leaders must develop, and the safeguards needed to manage emerging risks. It also outlines how NETSOL supports financial institutions in adopting AI responsibly combining deep industry expertise with configurable, governance-ready solutions that balance innovation with compliance.

AI in BFSI: From theory to tangible impact

For leaders in banking and financial services, the conversation around AI often gets stuck in theory.

What matters is measurable impact. AI in BFSI is no longer about experimentation. It’s about solving high-stakes problems with clarity, speed, and defensibility.

Here are four areas where the shift is already visible.

1. AML transaction scoring

Traditional AML systems flood compliance teams with false positives, draining capacity and frustrating customers. AI-driven transaction scoring utilizes adaptive algorithms to minimize noise while enhancing detection accuracy.

The result? Fewer manual reviews, faster case resolution, and stronger defenses against financial crime. KPIs include percentage reduction in manual review hours, lower false-positive rates, and faster time-to-resolution.

2. Predictive stress testing

Legacy stress testing often underestimates tail risks. When volatility hits, those blind spots translate into capital shocks. With AI-powered risk management, predictive stress testing models simulate thousands of non-linear scenarios.

This means earlier identification of tail exposures and better preparation for macroeconomic turbulence. KPIs include improved tail-loss coverage and scenario accuracy.

3. Credit counterfactuals

Credit models are under increasing regulatory scrutiny. The problem is not only accuracy but also explainability. Counterfactual analysis showing why a decision was made and how it could have been different, gives institutions audit-ready transparency.

For CTOs and COOs, this means developing defensible models, reducing remediation costs, and minimizing reputational risks.

Key KPIs: reduction in adverse-action reversals, audit clearance times, and compliance costs.

4. Automated KYC and onboarding

Onboarding is a frontline experience. Delays here translate directly into lost revenue and customer attrition. Automated KYC solutions powered by AI streamline document verification, anomaly detection, and approval workflows.

You’ll see clear, measurable results: faster onboarding, more work completed, and fewer drop-offs. Track this with time-to-onboard, overall throughput, and customer satisfaction metrics (e.g., CSAT or NPS).

Building AI governance: Five core capabilities for risk leaders in banking

The adoption of artificial intelligence in the BFSI market is uneven. Some banks have advanced fraud analytics or AI-based credit scoring.

Few, however, have enterprise-level governance that keeps pace with regulatory expectations.

That’s where most fines, audit failures, and reputational damage come from. Closing this gap requires building five core capabilities.

1. Data and feature operations

Everything starts with data. Without a single source of truth, risk teams waste hours debating whose numbers are “right.”

AI in risk management for finance demands disciplined data pipelines, lineage tracking, version control, privacy-preserving joins, and immutable audit logs.

This creates trust in every model output. Think of it as building the foundation of a house. If the base is shaky, nothing above it holds.

2. Model lifecycle and validation

Models don’t live forever. They drift, decay, and sometimes fail silently. That’s why regulators, such as the Federal Reserve, still hold firms to SR 11-7 standards.

The difference today is complexity; AI models are often opaque and dynamic. Risk leaders must inventory every model, run shadow tests before deployment, conduct adversarial checks, and backtest continuously.

Independent validation teams, not developers, must own this process. If done with proper guidance and assistance, this builds confidence that models are not only innovative but also reliable under pressure.

3. Explainability and auditability

If a customer is denied a loan, regulators demand an explanation. If a suspicious transaction is flagged, auditors need evidence. Black-box AI can’t deliver this on its own.

Banks must invest in explainability frameworks that produce human-readable rationales and counterfactuals for every decision. Audit trails should be persistent and retrievable on demand.

The goal is simple: no decision should ever be beyond explanation. This reduces compliance risk and builds trust with both regulators and customers.

4. Governance and model risk management integration

AI must fit within the bank’s broader risk appetite and governance frameworks. That means aligning model use with escalation paths, risk categories, and board-level oversight.

Independent validators must sign off on any AI model before it is deployed to production. Effective governance ensures AI innovation doesn’t outpace accountability.

It’s how leaders prevent regulatory breaches while still scaling AI responsibly

5. Resilience, operations, and security

AI systems are critical infrastructure. If they fail, operations stall, fraud goes undetected, and regulatory deadlines are missed.

Leaders must demand SLA-backed performance, rapid mean-time-to-detect (MTTD) and mean-time-to-recover (MTTR), as well as rollback mechanisms when models misfire.

According to report by YStats, nearly 90% of GCC CEOs reported using Generative AI in 2024, outpacing global averages. Ystats.com

According to report by YStats, nearly 90% of GCC CEOs reported using Generative AI in 2024, outpacing global averages. Ystats.com

Vendor failover plans and diversified model sources reduce concentration risk. In practice, this means treating AI not as a project, but as an operational backbone that requires the same resilience planning as core banking systems.

Risks, mitigations and red flags

Successfully deploying AI models requires vigilance, especially when relying on external vendors. To move AI projects from proof-of-concept to secure, scalable production, teams must proactively address potential risks related to model transparency, vendor reliance, and ongoing performance checks.

Artificial intelligence in BFSI market- Action and accountability

The future of banking will be driven by, enabling smarter decisions and better customer experiences" -Jamie Dimon, CEO of JPMorgan Chase

The future of banking will be driven by, enabling smarter decisions and better customer experiences" -Jamie Dimon, CEO of JPMorgan Chase

If long-term outcomes are the goal, AI must be treated as an engineering and governance program, not a lab experiment.

Looking ahead, the GCC’s BFSI sector stands at an inflection point. As financial institutions double down on AI to guard against risk, they must partner closely with regulators to establish clear frameworks on data governance, model risk, accountability, and transparency that fit the region’s socio-economic, cultural, and regulatory makeup. Investments in talent (data scientists, risk officers familiar with both AI and local markets), infrastructure (secure cloud, robust data pipelines), and governance (Sharia-compliant AI, cross-border cooperation) will distinguish institutions that thrive from those that merely survive. Ultimately, for the GCC, AI’s promise in risk management is huge but realizing it will depend on disciplined implementation, ethical practices, and resilient regulatory oversight.

The AI in BFSI is redefining who can predict risk accurately and who remains exposed. Building the five capabilities and demanding explainability and audit rights from vendors are now baseline requirements.

This is not optional!

Regulators and stability bodies are already closely monitoring the situation. Firms that combine AI in risk management for finance with rigorous controls achieve lower losses, faster decision cycles, and greater resilience.

Revolutionizing risk management in banking is entirely possible, but it requires discipline, measurable metrics, and strong governance. That is how AI shifts from liability to lasting competitive advantage.

Connect with NETSOL to unlock the future of AI-driven risk management in BFSI.

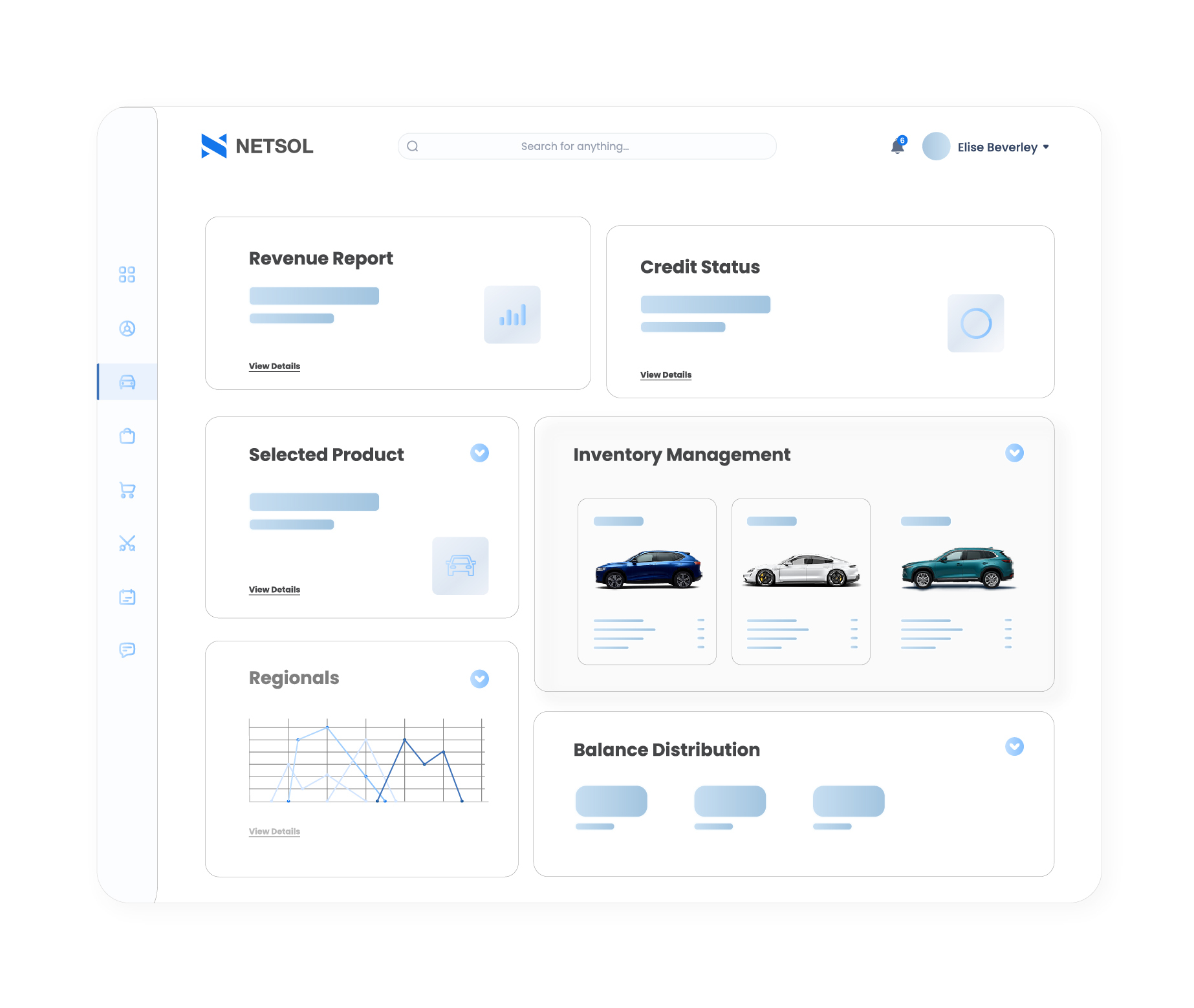

Leverage our 40+ years of global asset-finance expertise and AI-embedded platforms, Transcend Finance, AI Labs, and advanced analytics frameworks to move from exploration to execution. Our specialists deliver actionable benchmarks, regulatory-ready models, and implementation roadmaps that help banks and financial institutions mitigate risk, ensure compliance, and scale with confidence.

Related blogs

Blog

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog