Blog

The Future of Mobility: Mapping Progress within the Transportation Space

By Farooq Ghauri Managing Director, NETSOL Technologies, Inc., on June 7, 2018

Henry Ford and Kiichiro Toyoda changed the world within three decades, developing automobiles and accompanying production processes that would transform how humans navigated and shaped the world around them. However, this paradigm has shifted in recent years. Consumers today are poised to revolutionize the industry that once reconditioned them. New developments stemming from evolving buyer attitudes toward asset leasing and financing and technology usage are sweeping through the automotive industry and compelling great change.

Businesses within this transportation niche or the countless others that orbit it should take note of these disparate yet complementary phenomena and sketch blueprints for sustainable success. Here are three major events affecting the future of mobility:

Subscription-Based Car Ownership Emerges

Businesses in numerous industries have embraced the Netflix model, which involves selling access to products and services through flexible, short-term lease agreements. Why? Young people, particularly the millennials who constitute the largest portion of the American workforce, according to Pew Research Center, are averse to making large purchases. For instance, just 15% of millennials consider buying a home an extremely important priority, according to Goldman Sachs. While members of Generation Z, which includes people born after 1995, maintain more traditional economic values, millennials' growing buying power gives them a license to shape the marketplace. And organizations everywhere are embracing subscription-based services as a result - including vehicle dealerships and manufacturers.

Young consumers have been using ridesharing services like Uber and Zipcar for years. However, these offerings seemed like steppingstones on the path to vehicle ownership. Automakers and dealers operated under the impression that those sharing rides and vehicles would eventually seek out total automotive independence. Now almost half of the millennials and Gen Yers who take advantage of such services question whether they need to purchase or lease origination software vehicles at all, analysts for Deloitte discovered. Increasing vehicle ownership costs are certainly not helping the situation. With the average new car payment nearing $550 and the average lease payment hovering around $450, as per Experian, many young buyers are choosing to opt out of the automotive marketplace. That said, some startups and forward-thinking dealers are looking to regain ground in this demographic by embracing the Netflix model.

Flex drive is the most visible company pursuing this strategy. The Atlanta-based startup partners with dealers across 11 states to offer vehicles across seven subscription tiers. Users sign up for the service through a mobile application, select vehicles within their ideal monthly payment ranges and head to participating dealers for pickup. The per-month prices, which range from $400 for compact cars to $1000 or more for luxury vehicles, include maintenance, insurance and roadside assistance. Canvas, headquartered in San Francisco and funded by Ford, offers comparable options in three cities. A good number of manufacturers have also entered the subscription-based automotive arena, including Audi, BMW, Cadillac, Lexus and Jaguar Land Rover. That said, these and other OEM programs typically come with heftier price tags.

As the Netflix model transforms into the primary enterprise modus operandi, something that economic experts for Stanford University believe is all but inevitable, more dealers and automakers will shed traditional operational approaches and adjust their offerings to meet the needs of commitment-weary millennials and Gen Yers.

The Need for Mobility Management Increase

The transportation ecosystem is perhaps more diverse than ever before. Bike shares, car shares, moped shares, scooter shares, buses, subways, privately owned vehicles, taxi services and so on - the mobility options are plentiful. And with autonomous vehicles slowly moving out of the laboratory into the streets, the selection of consumer transportation opportunities could grow. This seems like an ideal situation on the surface. However, this surplus of mobility choices is choking some cities. The ride-hailing service providers operating in New York City are clogging streets across the five boroughs, as per research from Schaller Consulting. Shareable scooters are having a similar effect on both roadways and sidewalks in metropolitan areas such as Austin and Washington D.C., raising safety issues, The Atlantic reported. Addressing these issues is obviously essential to the enterprise mobility, but how do public and private stakeholders proceed? Embracing mobility management solutions might be the answer here, according to analysts for Deloitte. The various entities navigating the transportation arena today leverage this strategy but do so in an isolated fashion. Uber monitors its fleets to ensure it is meeting real-time customer demand; Bird tracks its scooters to ensure users can access charged devices; municipal transportation authority's observe train routes to ensure passengers are getting where they need to go on time. There is little collaboration between these parties, leading to adverse mobility situations across multiple modes that increase and grow worse over time, and ultimately drag down consumer satisfaction. Top-down mobility management has the potential to solve this issue by facilitating collaboration among transportation providers in both the public and private spaces. Deloitte envisions an immediate future in which so-called mobility advisers work with various third-party data collection, storage and sharing providers to coordinate mobility operations in the context of local networks. The consultancy also indicated that asset owners would play essential roles in mobility management following the widespread adoption of autonomous vehicles, many of which will be shared in the early days of self-driving if Uber and its $1 trillion fleet of driverless vehicles have anything about the subject. As the number of transportation options grow, so does the need for large-scale oversight and planning - two functions mobility management can facilitate.

Automotive Artificial Intelligence Matures

Organizations across numerous industries are aggressively pursuing artificial intelligence technology, including those navigating the automotive space. These companies spent more than $344 million on AI applications in 2018, catalyzing a 78% year-over-year investment increase, according to Research and Markets. Annual AI expenditures within the space are expected to reach $533 million this year and ultimately surpass the $3 billion mark by 2025, the market research firm projected. These funds are earmarked for an immense array of projects - most notably, autonomous vehicle development programs. More than two-dozen organizations have embarked on such efforts, from automotive technology startups such as Waymo and Oxbotica to vehicle manufacturers like General Motors, Ford and Toyota. Sophisticated AI software propels driverless technologies materializing within these initiatives, allowing unpiloted vehicles to make life-and-death decisions in real time. These programs vary in approach, Venture Beat reported. Intel's Mobileye platform records good driving habits and codifies them for use, while Nvidia's Safety Force Field leverages advanced motion sensors and processing gear to inform vehicle movement. And the Massachusetts Institute of Technology recently revealed a driverless car system that achieves human reasoning via mapping and visual data review. Although there is no definitive timetable for the widespread release of driverless vehicles, many of the companies churning out these next-generation assets are almost ready for launch. For instance, U.K. cab service Addison Lee plans to debut its first autonomous taxis in 2021, according to the International Data Group. Tesla Cofounder, CEO and Product Architect Elon Musk told Ark Invest that his company would roll out fully functional self-driving vehicles by the conclusion of 2019. While autonomous vehicle technology is perhaps the most visible automotive innovation involving A.I., there are many other equally impactful applications unfolding within the industry. Researchers for McKinsey and Company highlighted key backend customer support, marketing, operations and sales tools that could benefit from the emergence and crystallization of A.I. Predictive maintenance systems that ensure production-line uptime; key performance indicator-propelled design-to-value solutions that increase the likelihood of marketplace success; intelligent spend-management solutions that facilitate revenue-building operations - the potential A.I. implementations here are countless. However, dealership finance departments are perhaps best positioned to take advantage of back-office A.I. technology due to the arrival of computer-assisted underwriting and financing platforms. A number of prominent automotive asset financing and leasing entities have already begun pursuing these unique offerings, The Wall Street Journal indicated. Ford Motor Credit Company and Synchrony Financial are reportedly using A.I. to generate complex borrower qualification models that measure risk based on countless data points, including personal financial management minutiae such as the number of loan payments three months or more past due or default rates for mobile phone bills and rent payments. With hundreds or thousands of these indicators in hand, lenders can protect themselves and provide more responsive financing and leasing services.

These advancements indicate that automotive A.I. technology is nearing an inflection point, as software that was once deployable only within laboratory environments appears to be primed for release in the wild. The mass deployment of A.I., even in backend software systems, will catalyze significant change across the transportation landscape, permanently altering internal operations and the customer experience.

Adjusting to Industry Change

As these and other transformations unfold and establish the foundation for the future of mobility, businesses navigating the automotive industry must take action but what kind? Process reassessment is the first step - automakers, dealerships and others within the space must re-evaluate their existing workflows, including those related to financing and leasing, and search for weaknesses that inhibit optimization and innovation. Pinpointing and implementing fresh technologies to address these faults is next, as cutting-edge digital tools establish the foundation for sustainable growth.

By taking these steps, car manufacturers and auto dealerships can optimize their operations and find success, even as disruptive technologies and consumer proclivities change the mobility marketplace.

Related blogs

Blog

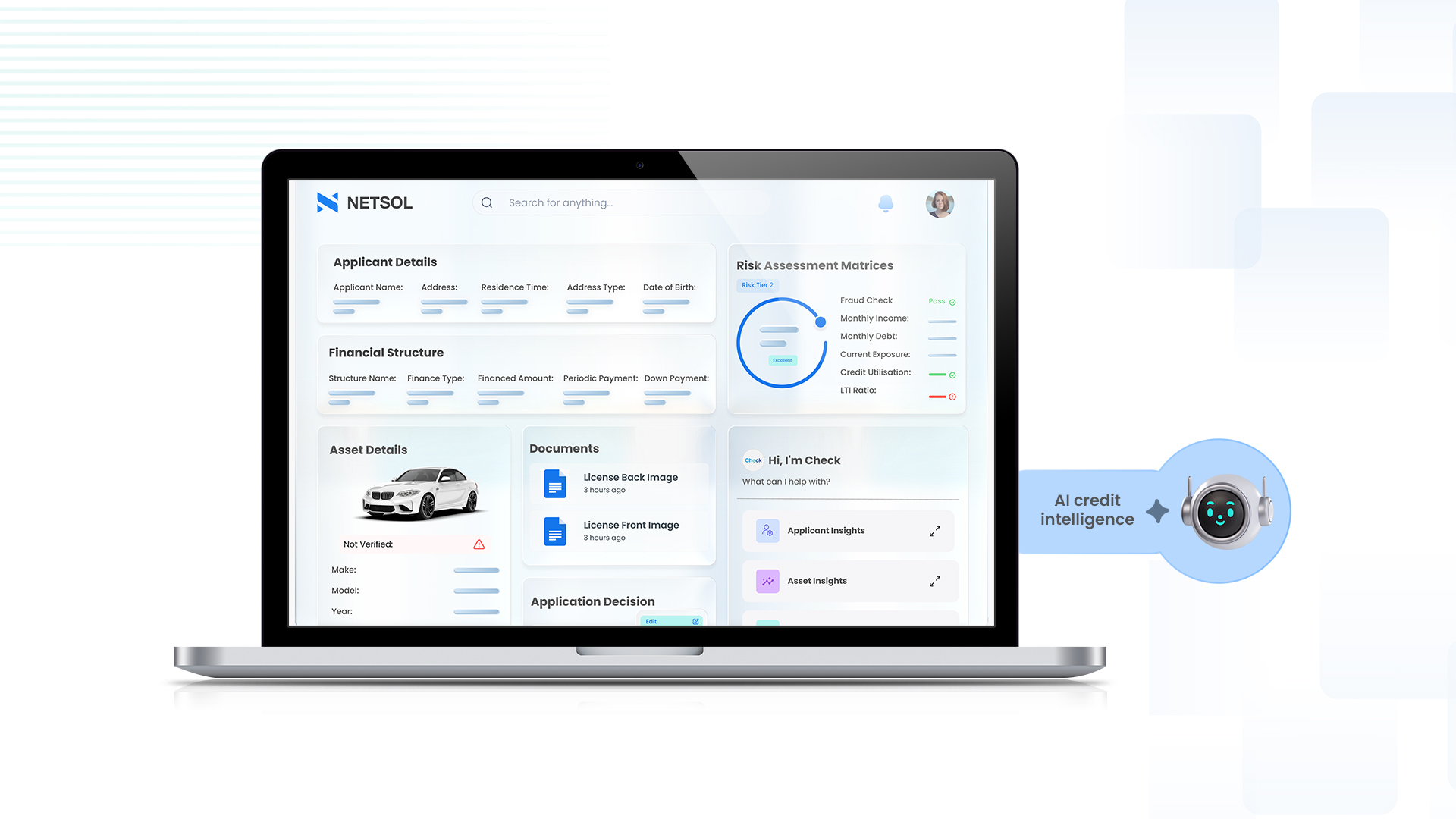

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog