Blog

Intelligent deal structuring: The new standard in digital retail platforms

By NETSOL Technologies , on December 12, 2025

Discover how intelligent deal structuring transforms digital retailing by unifying AI desking, compliance, and multi-lender workflows to boost F&I profit and trust.

The digital retail revolution has moved far beyond simply listing products online. The initial wave was about convenience and selection. The next, and most transformative, wave is about intelligent monetization at the point of sale.

For high-consideration purchases, particularly in automotive, powersports, and heavy machinery, the final deal structure is not just a transaction, instead, it's the realization of the customer journey and the primary source of backend profitability.

Yet, for too long, this critical phase has been hindered by legacy processes. Manual calculations, siloed lender criteria, and opaque pricing models create friction, erode customer trust, and leave significant revenue on the table. The future, and the new competitive standard, belongs to Intelligent Deal Structuring.

This isn't just automated desking. It's an all-inclusive, AI-powered approach that instantly generates optimized, compliant, and transparent deal structures personalized to each unique buyer profile. It’s the strategic brain that empowers your sales and F&I teams to act as trusted advisors, closing deals faster and more profitably.

The high stakes of the modern deal

Today’s consumer is digitally native, financially savvy, and demands a seamless, transparent experience. They have been conditioned by Amazon and Netflix to expect personalization, and they bring those expectations to the showroom, whether it's physical or digital.

"In the future, dealerships will have very few cars. With virtual reality, buyers can easily modify them." ~Thomas Furcher

Thomas Furcher, a partner at McKinsey and Company in an interview, shared that a major cost driver in the current distribution setup is the number of cars at a dealership. In the future, dealerships will have very few cars. And through virtual reality, you can modify them and experience them in different ways. When the end customer requires a car in red, the virtual reality will transform it into a different color or with different features.

The cost of getting this wrong is immense. Inefficient desking leads to:

- Lost profits: Suboptimal lender placement and failure to identify the most profitable structure for both dealer and buyer.

- Compliance risks: Manual errors and inconsistent quoting expose the enterprise to significant regulatory penalties.

- Customer attrition: A clunky, slow, or non-transparent F&I process is the number one reason for cart abandonment in digital retailing.

The three pillars of intelligent deal structuring

Intelligent deal structuring is built on a foundation that balances what were once seen as competing interests. It harmonizes three core pillars:

- Profitability optimization

This moves beyond simply finding an approval. Advanced algorithms analyze real-time data from dozens of lenders, including captive and non-captive sources, to present structures that maximize backend income (reserves, products, etc.) while remaining attractive to consumers.

It can model different scenarios in milliseconds: what if the customer puts down another $500? How does a different term affect the overall profit? This is strategic desking at the speed of thought.

- Ironclad compliance

In an era of increasing regulatory scrutiny (like the FTC's Safeguards Rule), compliance cannot be an afterthought. Intelligent systems bake compliance into the workflow.

These automatically adhere to lender-specific rules, state and federal regulations, and internal dealer caps, creating a verifiable audit trail for every single deal generated. This transforms compliance from a liability into a scalable, automated asset.

- Radical customer transparency

The modern buyer is skeptical. They have tools and resources to validate their deal. Intelligent systems build trust by providing clear, jargon-free rationales for why a specific structure is being offered.

“Transparency is the bedrock of trust, especially in the age of artificial intelligence. Without transparency, there can be no accountability and without accountability, there can be no trust.” ~ World Economic Forum, "Our Shared Digital Future"

Transparency is the new currency of trust. Retailers that can clearly articulate the ‘why’ behind an offer will see higher conversion rate and significantly improved customer lifetime value.

The engine of intelligence: beyond basic automation

So, what powers this new standard? It’s the seamless integration of two critical technological capabilities:

- AI-powered smart desking

This is the core intelligence. By ingesting and processing thousands of data points, from the customer’s credit application and credit bureau data to real-time lender buy rates and dealer profit goals, the system doesn't just find “a” deal.

It generates the optimal deal. It can personalize structures for different buyer personas: the first-time buyer, the credit-challenged customer, the luxury buyer, and the fleet manager, each with unique needs and profitability potential.

- Seamless multi-lender workflows

The power of choice is critical. An intelligent platform connects your sales team to a vast network of lenders through a single, unified interface. This eliminates the need to jump between different portals and manually compare disparate offers.

The system automatically routes the deal to the most appropriate lenders, aggregates responses, and presents a clear, ranked list of the best options, saving hours of manual labor and ensuring no opportunities are missed.

Transcend Retail: architecting the new standard with NETSOL Tech

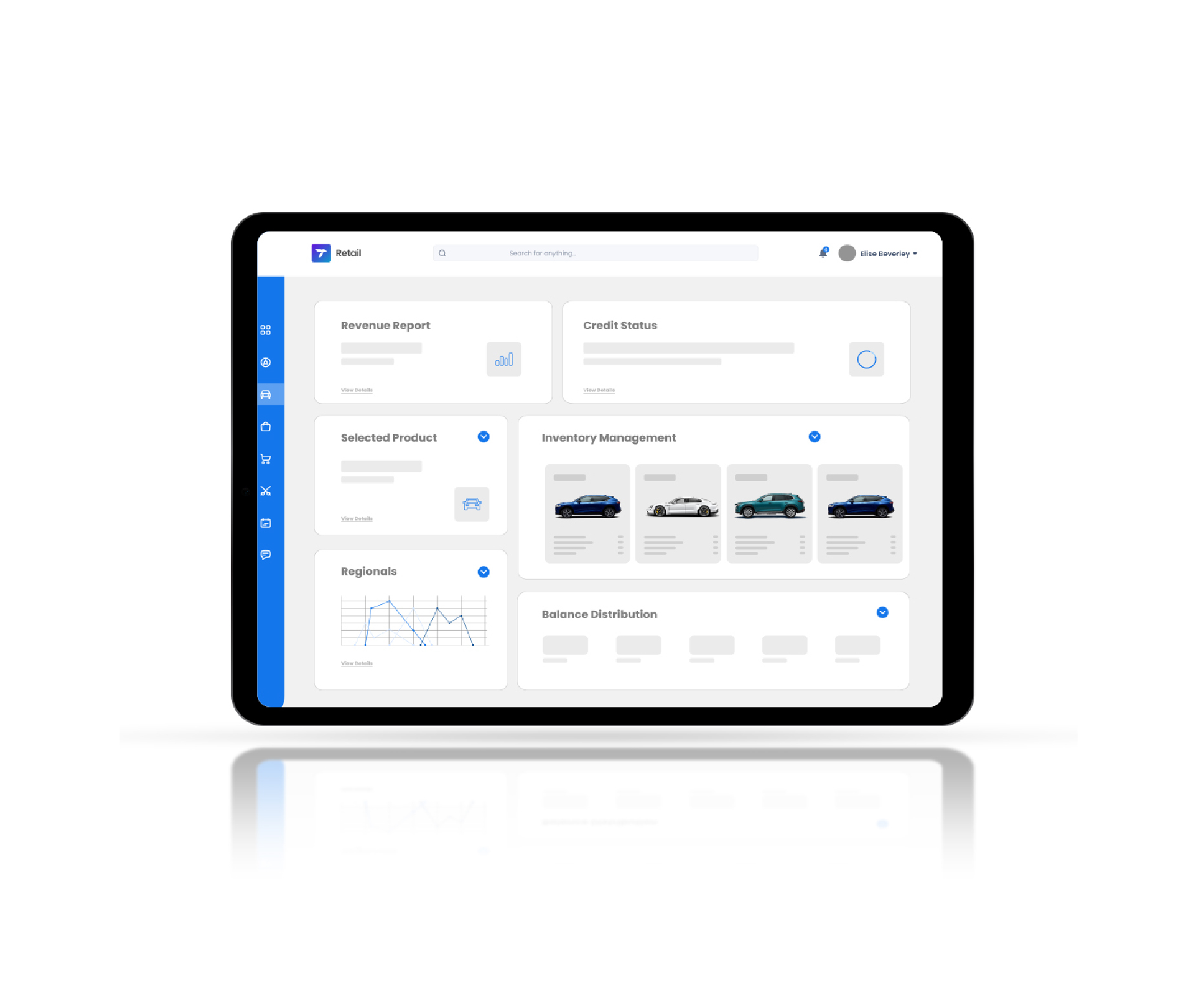

Understanding the theory is one thing; implementing it at scale is another. This is where the vision becomes reality with Transcend Retail. We have architected our solution not as a mere tool, but as the central nervous system for intelligent retailing.

Transcend Retail’s Smart Desking and F&I Hub capabilities are engineered to be the decision-making engine for enterprise retailers. Here’s how it delivers the new standard:

- Instantaneous, optimized structures

The moment a customer profile is entered, our platform performs a complex, multi-variable analysis. It evaluates all possible lender combinations, term structures, and product integrations to present a handful of the most profitable and customer-centric deals in seconds. This empowers your F&I manager to lead with confidence, not guesswork.

- Personalized to every buyer

There is no “average” customer. Transcend Retail’s algorithms are designed to recognize and adapt to different profiles. For instance, it can proactively structure a deal with higher approval odds for a sub-prime buyer while ensuring full compliance, or it can highlight the long-term value of a certified pre-owned warranty to a family-focused buyer, increasing product penetration and customer satisfaction simultaneously.

- The unified F&I hub

We dissolve the silos. Our F&I Hub acts as a single gateway to your entire lender network. This seamless workflow means your team spends less time on administrative tasks and more time building rapport and selling value. The system ensures that every deal is worked with maximum efficiency, capturing the best possible outcome from the financial market.

Implementation blueprint for enterprise decision makers

You don’t need a rip-and-replace. Prioritize these steps:

- Map the current deal path. Identify where customer data is lost or rekeyed; those are the bottlenecks.

- Pilot integrated desking + multi-lender routing. Start with a subset of stores and partner with lenders to measure time-to-sign, attach rate, and chargeback reduction.

- Instrument compliance checks and audit trails. Make every generated offer legally reproducible, this protects revenue and reduces disputes.

- Measure and iterate on KPIs. Track conversion lift, per-unit F&I income, dealer throughput, and compliance exceptions. Compare against baseline market indicators.

Common objections and how to answer them

Objection: “Point solutions already do this.”

Answer: Point solutions treat desking or lending as discrete jobs. Intelligent deal structuring is an orchestration layer; it binds data, pricing, and compliance so deals are generated once and closed cleanly. McKinsey’s research shows that isolated tech investments rarely deliver productivity without integration.

Objection: “We’re worried about lender acceptance and data security.”

Answer: Start with the lenders you already transact with and enable secure, standards-based data exchanges. Modern F&I hubs use tokenized connections and role-based access to keep data safe while speeding adjudication. Experian and industry lenders are already shifting shares and strategies, deal agility is the defensive move.

What does this mean for enterprise leaders

Here’s the thing: margins will tighten, buyer expectations will only get higher, and regulatory scrutiny will remain. Intelligent deal structuring is not a feature; it’s an operating model that turns pricing complexity into predictable revenue and convertibility.

Transcend Retail’s smart desking and F&I hub are positioned to be the operational layer that brings speed, accurate margins, lender agility, and compliance together, so your stores close more, waste less, and build trust.

It’s time to transform your F&I operations from a cost center to a growth engine.

Book a personalized demo today and see how intelligent deal structuring can future-proof your revenue.

Related blogs

Blog

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog