Blog

The digital imperative for brokers: Why automation will define the next era of asset finance

By NETSOL Technologies , on January 22, 2026

Discover how NETSOL’s Broker Portal helps UK asset finance brokers automate compliance, reduce risk, and scale through AI-driven technology.

The UK asset finance sector is facing unprecedented challenges. In the first half of 2024, global investment in artificial intelligence startups exceeded $35 billion, putting more pressure on brokers to adopt more efficient and tech-driven processes. This isn't just about staying competitive anymore; it’s about survival.

As brokers increasingly face competition from digital-first players and regulatory pressure grows, tech adoption is not a choice; it’s an absolute necessity. What was once seen as a long-term modernisation project is now a strategic requirement for brokers who want to scale, remain compliant, and deliver the speed customers expect.

Current UK asset finance broker landscape: Urgency for change

The UK asset finance sector plays a pivotal role in driving business growth through equipment, vehicle, and machinery financing. However, brokers today are contending with multiple pressures that demand a shift toward technology adoption:

- Client preference for digital solutions

UK SMEs now prefer initiating their finance applications through online platforms rather than brokers. Digital-first lenders like Funding Circle and iwoca are winning over brokers' market share with their faster and online application processes.

In May 2024, just over 60% of business banking customers used mobile banking, significantly outpacing the traditional broker model. Brokers who fail to offer digital solutions risk losing valuable clients to faster and tech-enabled competitors.

- Regulatory demands

The introduction of the FCA's Consumer Duty (July 2024) has set new expectations for brokers to prove that clients are treated fairly. Failure to comply could lead to severe fines and penalties. Manual compliance processes simply won’t keep up with these evolving rules.

In fact, brokers using manual systems could be at risk of non-compliance in an environment where real-time data and automated processes are becoming the standard.

- Operational inefficiencies

Brokers using paper-based systems and manual deal structuring are spending too much time on administrative tasks, slowing down deal closure times. According to recent data, UK brokers are facing average processing delays of up to 5 days per deal. This time is critical, as competitors utilizing digital platforms can secure faster approvals and get deals closed quicker.

Tech adoption in improving operational efficiency

Challenges and pain points faced by UK brokers

Despite their important role in the UK asset finance sector, brokers are facing a range of challenges:

1. Manual, time consuming processes

Despite the rising demand for asset finance, a significant number of brokers continue to rely on manual workflows, paper-based deal structuring, client communications, and document management. These outdated methods increase deal turnaround time and create opportunities for human error, affecting client satisfaction.

2. Limited data and insight

Brokers often lack real-time data to provide a personalised service. Without a centralised digital platform, tracking the status of deals, understanding client needs, and spotting new opportunities becomes cumbersome. Brokers report that accessing client data in real-time is a major hurdle in meeting customer expectations.

3. Regulatory pressures

The UK asset finance sector is heavily regulated. Brokers must comply with strict rules and regulations to ensure that they are adhering to industry standards and legal requirements. Keeping up with these regulations manually is both challenging and risky.

4. Changing customer expectations

Customers today expect instant gratification. In the age of instant approvals and online services, customers in the UK asset finance sector are looking for quick and seamless transactions. Brokers who cannot offer this risk losing business to more digitally savvy competitors.

5. Rising insolvencies and risk management

An additional challenge brokers face is the rising rate of insolvencies, which increased by 18% year-on-year in April 2024, according to government data (Asset Finance Connect). With client defaults on the rise, brokers must enhance their risk assessment strategies and leverage technology to ensure robust risk management.

6. Increasing competition from digital lenders

Digital-first platforms are increasingly becoming the go-to for UK SMEs looking for faster finance options. These platforms provide instant decisions and automated workflows that brokers can't replicate without advanced technology.

Tech adoption key benefits for brokers

Bespoke technology solutions tailored to their specific needs offers brokers a strategic advantage. Here are the key benefits of investing in such custom-built systems:

- Tailored fit for unique business needs

Off-the-shelf solutions often fail to address the nuanced requirements of individual brokers. Bespoke tech allows brokers to design systems that align precisely with their operational workflows, client engagement strategies, and compliance needs.

For brokers, this means reducing double data entry, eliminating fragmented systems, and enabling a single source of truth, from enquiry to settlement.

For example, a bespoke system can integrate custom features such as automated loan origination, AI-driven credit scoring, and customisable dashboards, features that standard solutions often lack.

- Enhanced operational efficiency

Bespoke systems streamline processes by automating repetitive tasks and reducing administrative burdens. This leads to improved look-to-book ratios and high transaction volumes without proportionally increasing costs.

Automated document gathering, digital ID verification, and pre-configured workflows allow brokers to handle greater case loads with fewer resources, unlocking economies of scale that manual brokers simply cannot achieve.

- Competitive differentiation

In a crowded marketplace, bespoke technology can set brokers apart by offering unique client experiences. Integration of AI-driven tools for personalised customer journeys enhances client satisfaction and loyalty. Custom portals and dashboards allow brokers to provide real-time updates and tailored insights that competitors using standard solutions cannot match.

- Cost efficiency over time

While the upfront costs of bespoke development may be higher, the long-term savings are significant. Avoiding recurring licensing fees associated with third-party platforms reduces operational expenses over time. Modular development allows for incremental investment, enabling brokers to prioritise critical functionalities first and expand as budgets permit.

Key technologies brokers must adopt to stay competitive

As the UK asset finance market digitises, brokers need to leverage the following technologies to remain competitive:

Key technologies within NETSOL’s Broker Portal

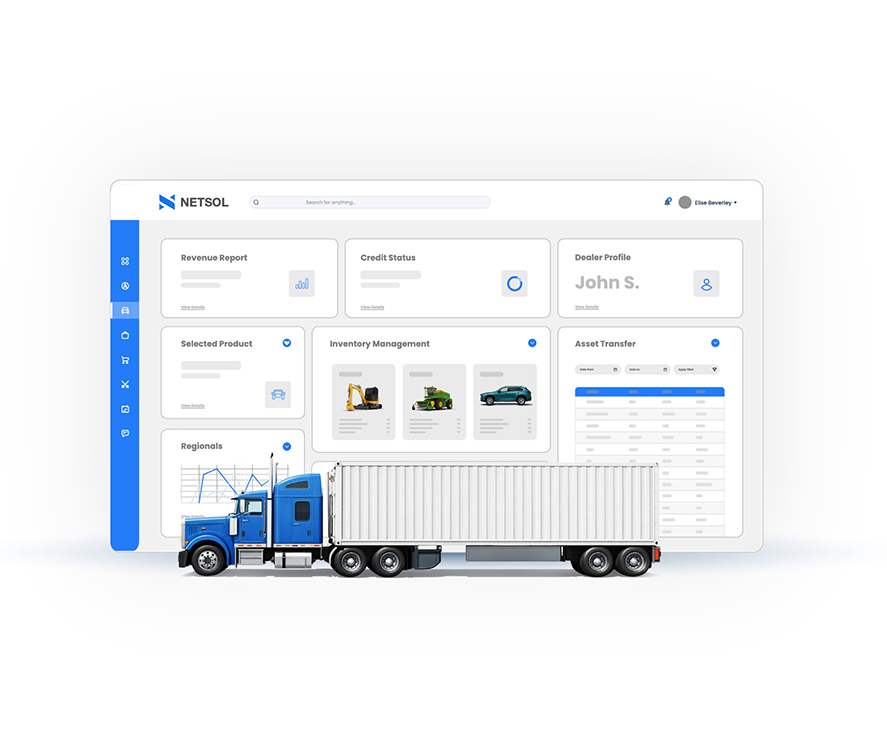

To stay competitive in today’s digital age, brokers must adopt the latest technology. NETSOL’s Broker Portal incorporates the following cutting-edge features:

- AI-powered risk scoring

Real-time, AI-driven models analyse historical data to improve risk assessment accuracy and reduce defaults.

- Automated compliance management

Automates FCA regulation checks, ensuring compliance 24/7.

- Integrated open banking APIs

Instant access to SMEs' verified financial data, enabling faster underwriting decisions.

- Digital contract management

Automates the contract creation and signing process, reducing deal closure time by up to 80%.

- Client self-service portals

Enables clients to manage their own applications, upload documents, and track deal progress.

Conclusion

Tech adoption is not just a trend; it’s a necessity for brokers in the UK asset finance sector. As the industry continues to evolve, brokers who embrace technology will not only streamline their operations but also enhance their customer service and stay competitive in a crowded market.

The real opportunity lies in adopting connected and automated workflows that give brokers the speed, compliance confidence, and insight-driven decisioning required for the next phase of growth.

NETSOL’s Broker Portal offers a comprehensive suite of tools designed to streamline operations, provide real-time market insights, and enhance client management. With NETSOL’s innovative technology, brokers can stay ahead of the curve, deliver personalised services, and operate seamlessly in today’s dynamic market. Book a demo now and see how NETSOL can help you succeed!

Related blogs

Blog

From credit checks to credit intelligence: How AI is redefining underwriting for captives

Blog

Shared financing models for high-value assets unlocking Indonesia’s next wave of growth

Blog