Wholesale Finance

Master wholesale finance operations with AI

Gain a competitive edge by automating your wholesale finance and floor planning operations effortlessly.

Why NETSOL

Power your supply chain for wholesale finance

and floor planning

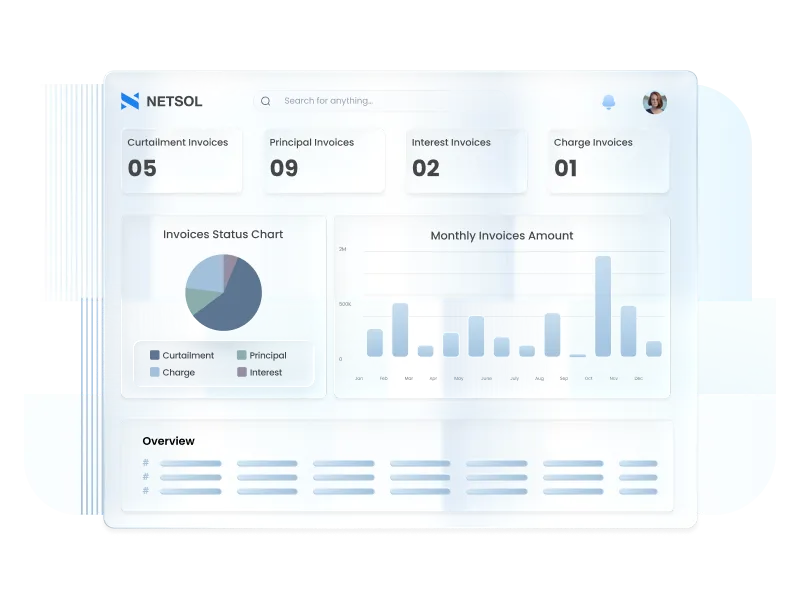

Gain access to top-tier wholesale finance software and provide your dealers, distributors and auditors with unmatched user experiences. Streamline processes, manage risk, reduce costs, increase dealer engagement and improve customer satisfaction in wholesale financing. Intuitive designs and custom workflow automation accelerate processes by eliminating bottlenecks. Users can navigate the platform easily, enhancing productivity and streamlining operations.

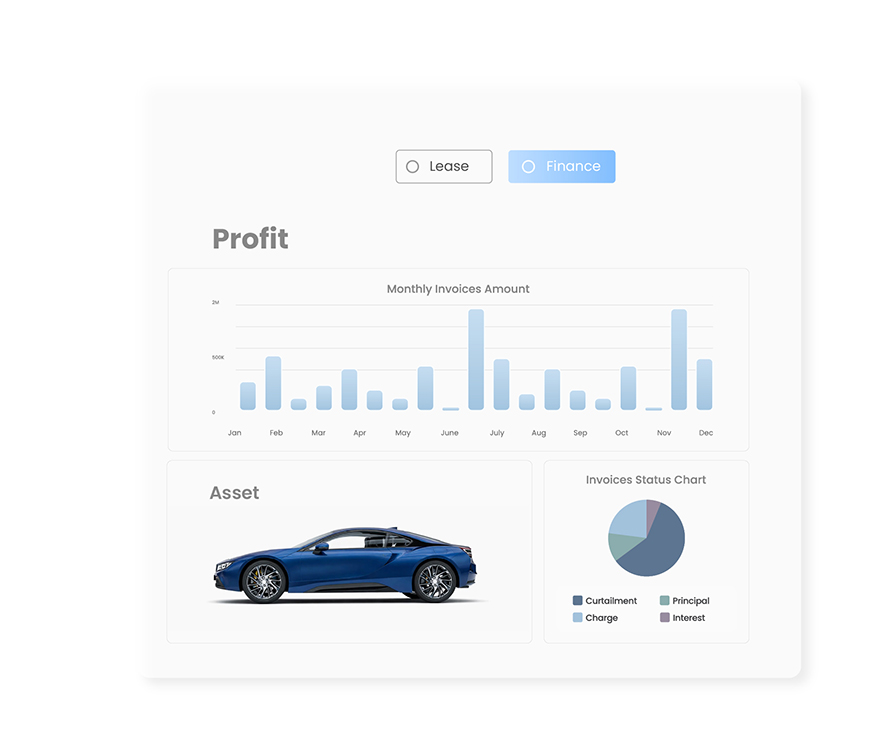

Advanced floor planning

Utilize powerful floor planning tools for complete contract lifecycle management, resulting in real-time business intelligence and enhanced collaboration.

Customizable solutions

Our system is highly flexible – designed with configuration and not code in mind, enabling lenders to tailor loans for specific clients and risk factors.

Seamless compliance

We offer an unparalleled experience with easy customization to meet tax and accounting requirements in any jurisdiction, fully adhering to all compliance requirements.

Versatile financing

Our wholesale financing solutions support both asset and non-asset-based financing. Further, new products can be easily designed and setup in the system.

0

Assets managed globally

0

Successful implementations

0

Customers worldwide

0

Countries served

End-to-end control and built-in intelligence

Ready to optimize your wholesale financing operations?

Tailor financing options to meet the diverse needs of dealers and borrowers. Whether it's floorplan financing, revolving credit lines or term loans, our technology provides flexible financing solutions to accommodate various business requirements.